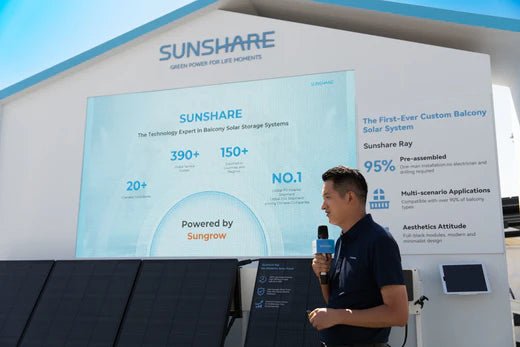

Good news! The zero-tax policy in Germany for photovoltaic systems under 30 kWp will continue

The Federal Government will continue to grant tax relief for photovoltaic systems on multi-family houses and single-family houses with less than 30 kWp or less than 100 kWp, respectively, namely

(1) The 19% VAT applicable on the purchase, import and installation of photovoltaic systems is exempt.

(2) The feed-in tariff for the photovoltaic system is exempt from income tax;

(3) The tax procedure is simplified and there is no need to apply for additional tax rebates.

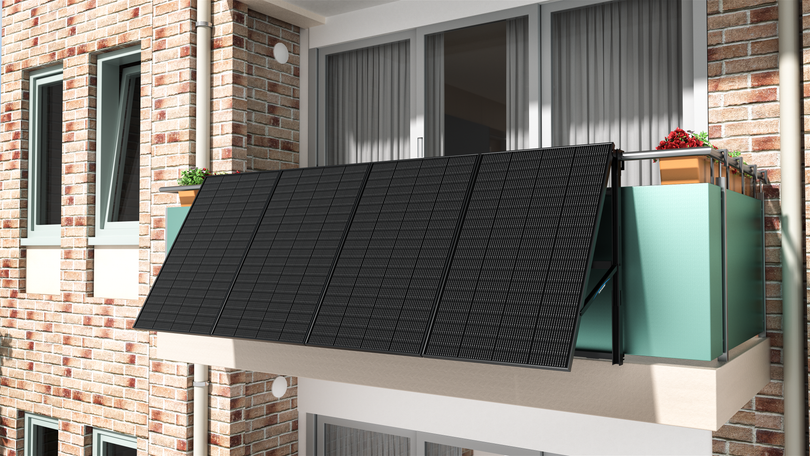

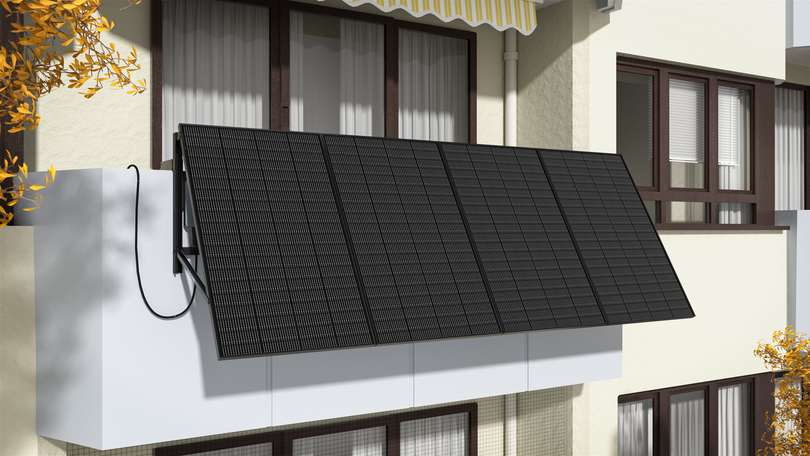

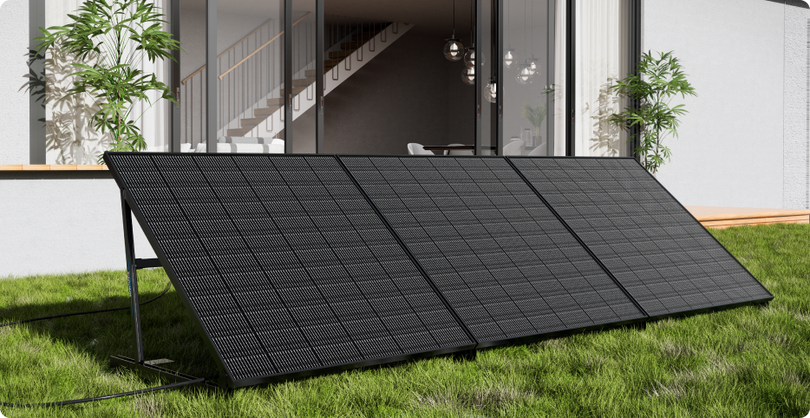

For end users, as the price of installing photovoltaic energy storage becomes more attractive, this initiative will stimulate further growth of the German residential photovoltaic market and promote the popularity of photovoltaic systems, and it is foreseeable that the residential market share will continue to grow steadily in the future.